What Is MiCA?

The Markets in Crypto-Assets Regulation (MiCA) institutes uniform EU market rules for crypto-assets issued by ESMA (European Securities and Market Authority). The regulation covers crypto-assets not currently regulated by existing financial services legislation. Critical provisions for those issuing and trading crypto-assets (including asset-reference tokens and e-money tokens) cover transparency, disclosure, authorization, and supervision of transactions. MiCA framework will support market integrity and financial stability by regulating public offers of crypto-assets and by ensuring consumers are better informed about their associated risks.

Markets in Crypto-Assets (MiCA) regulation covers Know Your Customer (KYC) procedures for wallets. MiCA broadens the existing anti-money laundering (AML) rules to the crypto sector and removes the threshold for KYC requirements, meaning that even the smallest crypto transactions require KYC compliance. This includes both hosted (custodial) and unhosted (non-custodial) wallets.

Furthermore, the MiCA framework is designed to complement existing AML rules, aiming to enhance financial stability and investor protection in Europe. Under MiCA, all cryptocurrency wallets are required to implement KYC procedures.

Implementation and Geographic Scope

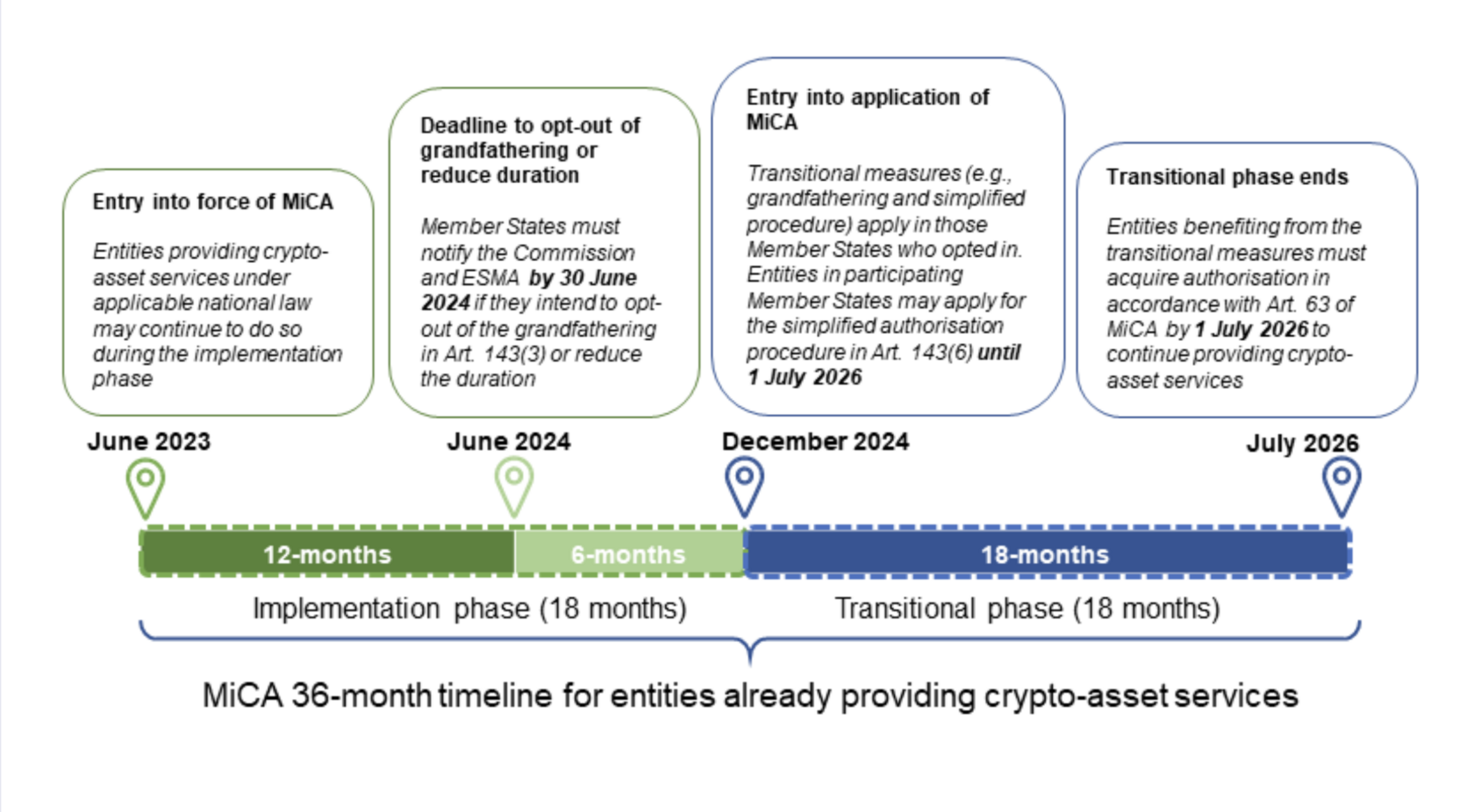

MiCA entered into force in June 2023. The regulation stipulates that rules on asset-referenced tokens and e-money tokens will apply from 30 June 2024, with the broader regulation taking effect from 30 December 2024. MiCA is directly applicable across all 27 EU member states as an EU regulation, thereby harmonizing the approach towards crypto-asset regulation throughout the EU.

MiCA Implementation Timeline by ESMA:

History of MiCA

MiCA is part of the EU's digital finance package, which the European Commission adopted in September 2020. This package includes measures to strengthen the EU's rules on anti-money laundering and counter-terrorism financing. MiCA was developed in response to the crypto-asset market's rapid growth and evolving nature, aiming to fill regulatory gaps and address potential risks to financial stability and consumer protection.

MiCA Titles and Structure

MiCA's structure and titles are laid out to cover various aspects of the crypto-asset environment within the European Union, ensuring comprehensive regulation. The MiCA framework sets out specific requirements for different market participants:

Title I: General Provisions

This section outlines the subject matter, scope, and definitions applicable under MiCA. It sets the groundwork for the regulatory framework, specifying what is to be considered a crypto-asset and outlining the overall objectives and applications of the regulation.

Title II: Rules for the Public Offering of Crypto-assets and Their Admission to Trading

This part details regulations concerning the public offering of crypto-assets other than asset-referenced tokens and e-money tokens. It includes the requirements for transparency and disclosure to ensure investors are well-informed.

Title III: Regulations for Asset-referenced Tokens

This section focuses on asset-referenced tokens (often known as stablecoins). It specifies the requirements for issuers of these tokens, including authorization processes and operational standards to ensure financial stability and consumer protection.

Title IV: Regulations for Issuers of E-money Tokens

Similar to Title III, but focused on e-money tokens, this title outlines the regulatory requirements for their issuers, ensuring that these tokens remain stable and reliable for consumers.

Title V: Operating Conditions for Crypto-asset Service Providers

This part covers the licensing and operating conditions for crypto-asset service providers (CASPs), detailing the standards they must meet to operate within the EU. It includes provisions on consumer protection, operational resilience, and governance standards.

Title VI: Prevention of Market Abuse

This section is dedicated to preventing market abuse, including market manipulation and insider dealing in the crypto-asset markets. It establishes clear rules to maintain market integrity and protect investors.

Title VII: Powers of National Competent Authorities, European Banking Authority, and European Securities and Markets Authority

This title outlines the powers and responsibilities of national and European authorities in supervising and enforcing the MiCA regulations, ensuring that there is a coordinated approach across the EU.

Title VIII: Execution and Delegation

This section covers the powers granted to the European Commission to adopt delegated acts, ensuring that MiCA can be effectively implemented and adapted over time.

Title IX: Transitional and Final Provisions

The final title details the transitional arrangements and other provisions necessary for the smooth introduction and ongoing application of the MiCA regulations.

Each title within MiCA is aimed at creating a secure, transparent, and stable digital finance environment within the EU, addressing both the opportunities and risks presented by the growing crypto-asset market. You can read more details on Titles and Structure here.

MiCA Exclusions

The regulation does not apply to certain crypto-assets and service providers, such as those covered by other EU financial services acts, services provided exclusively within a corporate group, and certain public institutions like the European Central Bank. Unique and non-fungible tokens (NFTs) are also excluded from the regulation.

How Can Hypersign Help

Hypersign is an on-chain and reusable KYC technology provider with a Self-Sovereign Identity infrastructure recognized by the World Wide Web Consortium (W3C). Hypersign can assist projects in the EU or those managing EU users with complying with MiCA regulations. For more information, please reach out to us at meet.hypersign@gmail.com.

FAQs

Q: Does MiCA cover all types of crypto-assets?

No, it mainly targets asset-referenced tokens, e-money tokens, and certain activities by CASPs but excludes assets covered by other financial regulations and NFTs.

Q: Will MiCA stifle innovation in the crypto space?

While some argue that MiCA could impose strict regulations, others believe it will foster innovation by providing a clear legal framework.

Q: How will MiCA affect cryptocurrency exchanges?

Exchanges operating in the EU must comply with MiCA's regulations, including obtaining a license and adhering to operational standards.

Conclusion

MiCA represents a significant step towards the structured regulation of crypto-assets within the European Union. Setting clear rules and standards aims to protect consumers, ensure market integrity, and foster innovation within the digital finance landscape. As the regulatory landscape continues to evolve, stakeholders within the crypto space should stay informed and prepare for compliance with MiCA's requirements.

About Hypersign

Hypersign is a cutting-edge, permissionless protocol designed to revolutionize digital identity and access rights management. By embracing the principles of Self-Sovereign Identity (SSI), Hypersign aims to empower individuals by allowing them to have full control over their own data and access on the internet. This platform offers a scalable, interoperable, and secure Verifiable Data Registry (VDR), which facilitates various applications rooted in SSI principles. Developed on the Cosmos-SDK, the Hypersign Identity Network has gained recognition from the World Wide Web Consortium (W3C), ensuring a robust, seamless, and secure management of Verifiable Credentials and Decentralized Identifiers. By providing solutions such as on-chain Know Your Customer (KYC) and Proof-of-Personhood, Hypersign stands at the forefront of digital identity, offering a more privacy-centric and user-controlled approach.

Get in touch with us today to understand the nuances of the decentralized identifier and on-chain KYC at meet.hypersign@gmail.com